In order to get started in creating your Corporation, LLC,or Nonprofit we will need general information such as:

Name of company

Purpose/Mission

Address

Phone

Principal/Manager Name

Agent of Process (Someone…friend, relative, or associate who is willing to be an intermediary in case of a legal suit-their information is only used for proof of mailing-They will not receive any other correspondence regarding your business)

LLC Preparation Payment $299, (plus state filing fee that vary by state $25-$100 that can be paid later to the Secretary of State), includes all document processing, Bylaws, preparation of Fictitious Business Name Statement, and Employer Identitifcation Number issued by the IRS. These are all required to open a Business Bank Account.

Corporation Preparation Payment $399, (plus state filing fee that vary by state $25-$100 can be paid later to the Secretary of State), includes all document processing, Bylaws, and preparation of Fictitious Business Name, and including your Employer Identification Number issued by the IRS. These are all required to open a Business Bank Account

Nonprofit Organization Preparation Payment $399 (if less than $10,000 of donation income) or $699 (if over $10,000). Before you begin the process review this link, https://www.councilofnonprofits.org/what-is-a-nonprofit

Documents can be processed same day for Articles of Incorporation

Secretary of State turn-around is 2-4 weeks based upon their work load

Formal Sole Proprietorship $149 includes IRS issued EIN, local wholesalers permit, and Fictitious Business Name Registration with your locality (excludes any locality fees which are usually $36-$50) Difference between a Sole Proprietorship vs LLC

Here are important forms to print and complete or bypass printing and use this online form Business Structure Intake

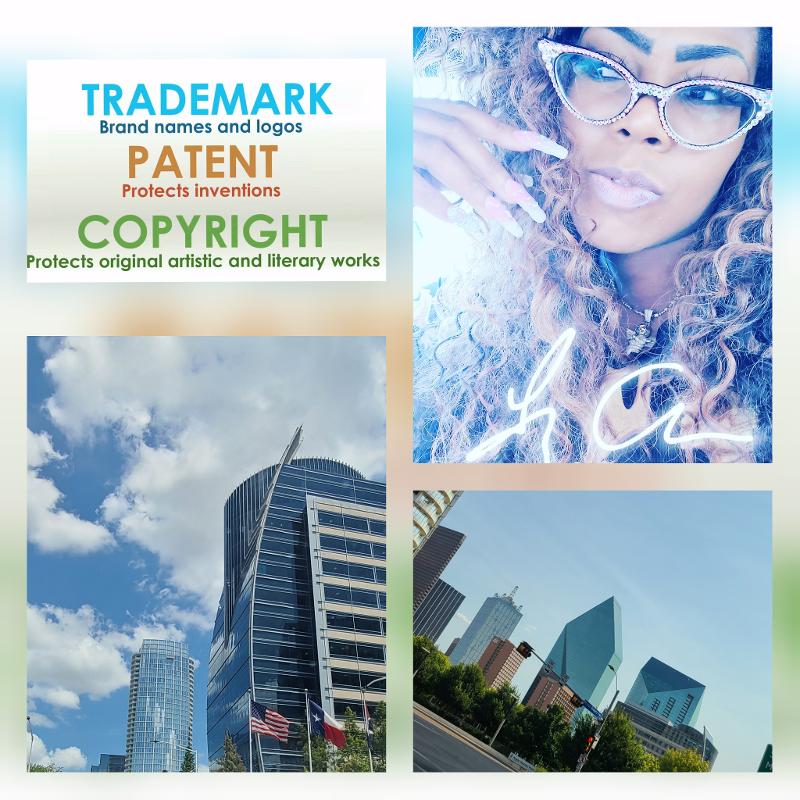

ASK ABOUT HOW TO PROTECT YOUR BUSINESS

NAME, LOGO, INVENTION, ART, MUSIC, ETC.

Trademarks $199 & up plus filing fee Patents $399 & up plus filing fee Copyright $99 & up plus filing fee